Since the cost of equity is the rate of return that an investor necessitates prior to investing in a particular company or taking on a project, it addresses the question of whether the potential return from the investment justifies the risk.Īdditionally, along with the cost of debt and the cost of preferred stock, the cost of equity is a central piece to calculate the weighted average cost of capital (WACC). Simultaneously, comparable investments with similar risk profiles should yield similar returns – assuming the investor made a reasonable decision. In other words, the cost of equity represents the “hurdle rate” that must be surpassed for an investor to proceed further with an investment.įor instance, if a company’s shares have a cost of equity of 8.0%, an investor should anticipate an ~8.0% return post-purchase.

One simple method to think about the cost of equity is that it signifies the opportunity cost of investing in the equity of a specific company.

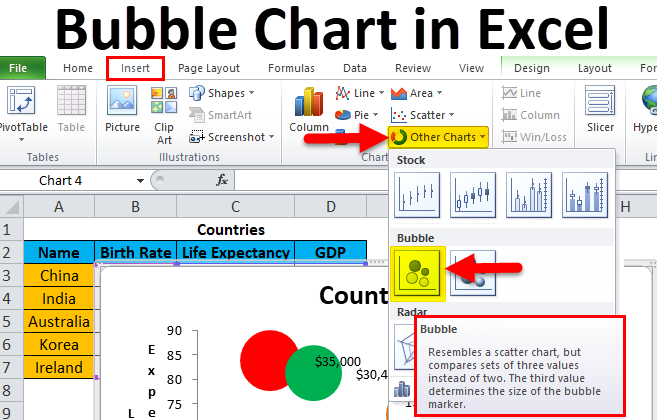

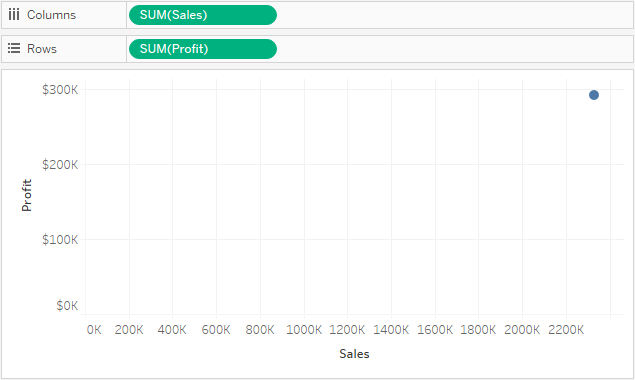

EQUITY RISK SCATTER CHART EXCEL HOW TO

You’ll learn how to set filters in data to selectively access data. This module introduces various data filtering capabilities of Excel. Module 3: Introduction to Filtering, Pivot Tables, and Charts Learners are introduced to the IF, nested IF, VLOOKUP and the HLOOKUP functions of Excel. This module introduces various Excel functions to organize and query data. Module 2: Spreadsheet Functions to Organize Data

EQUITY RISK SCATTER CHART EXCEL WINDOWS

To successfully complete course assignments, students must have access to a Windows version of Microsoft Excel 2010 or later. All along, Excel functionality is introduced using easy to understand examples which are demonstrated in a way that learners can become comfortable in understanding and applying them.

The course takes you from basic operations such as reading data into excel using various data formats, organizing and manipulating data, to some of the more advanced functionality of Excel. The course is designed keeping in mind two kinds of learners - those who have very little functional knowledge of Excel and those who use Excel regularly but at a peripheral level and wish to enhance their skills.

This is an introductory course in the use of Excel and is designed to give you a working knowledge of Excel with the aim of getting to use it for more advance topics in Business Statistics later. It is a very powerful data analysis tool and almost all big and small businesses use Excel in their day to day functioning. The use of Excel is widespread in the industry.

0 kommentar(er)

0 kommentar(er)